The bestselling guide, updated with new websites and ideas. Sharon Naylor believes that every bride deserves to have the wedding of her dreams. With this new edition of 1001 Ways to Save Money . . . and Still Have a Dazzling Wedding, she arms brides with more than 1,001 proven money-saving hints, tips, and strategies for creating a fabulous wedding without breaking the bank.Writing with verve and an infectious enthusiasm for all things bridal, Sharon walks readers through every wedding-related event-from announcing an engagement to planning a honeymoon to writing thank-you notes. She reveals where to cut corners and where not to, how to help families and bridal parties save money, where to find free assistance, and how brides can keep from feeling as if they’re shortchanging their dreams just to save a few bucks.For this revised edition, the author has put together an up-to-the-minute list of Web addresses and contact information for the best on-line, print, and brick-and-mortar bridal sources.

With gas prices constantly on the rise, it isn’t to anyone’s surprise that car owners are trying anything to get the most mileage out of their fuel. But just because your gas tank is quick to dry up doesn’t mean your bank account has to too. Make sure your wallet doesn’t run on fumes with these five need-to-know tips on how to save money on gas.

1. Commute and Carpool

The best way to save on gas money is share the gas expenses with others. If you stick to a routine schedule every week, try arranging a carpool where school and officemates can all benefit from a shared ride. Commuting is also another handy option. Especially on days where the roads get clogged up, subways and trains become a cheaper, faster way of getting where you need to go.

2. Drive Smart, Not Fast

If you really have to drive, make sure that you drive smart, not fast. Pushing the pedal to the metal isn’t always the efficient way to get where you’re going. Acceleration burns up gas, so as soon as you get to comfortable speed, maintain it. On the flipside, avoiding hard stops will keep you from burning gas when you need to speed up again.

3. Buy Where It’s Cheap

Not all gas stations are created equal, so keep your eyes peeled for the cheapest ones.

However, gas prices change almost daily so what works for you one day, may not be true the next. There are a good number of smartphone applications to help you track down a good gas bargain. If you have an iphone or ipod touch or any droid phone

you can easily use applications like Bottle Rocket’s “Gas Buddy” combines GPS technology with regularly updated gas prices in your area to give you a bird’s eye view of where best to gas up. Gas Buddy should be easy to find in the top app section on iTunes

4. Maximize a Bargain

Although it’s great to find a gas station that gives you a few cents off the gallon, it doesn’t make sense to drive miles and miles out of your way to get there. If there’s a gas bargain in the area, fill up your tank to the brim. It will save you money in the long run, as well as the trouble of gasing up a few dollars everytime.

5. Tune Up Your Car

Taking care of your car means more than filling her up when the gas guage lights up. A well maintained car is a vehicle that runs quickly, and more efficiently. Take the time to tune up your car and you’ll be rewarded with more miles per gallon, and more dollars in your pocket.

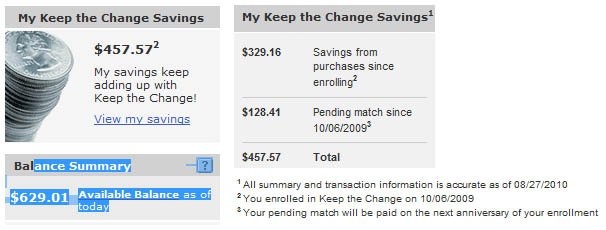

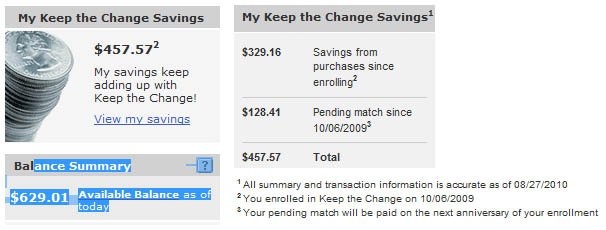

OK, I opened a Bank of America Keep the Change Savings account with $300 dollars. They automatically take the left over change on checkcard purchases, and put the change into your savings account. For example, a checkcard purchase of $10.01 would put .99 into your savings accent. In total your checking account would reflect -$11.00, and savings +$.99. The big incentive is that Bank of America will match some of your change… (restrictions below)

Started my account with $300, my change has added up to $329.16 and Bank of America is due to award me $128.41 on the anniversary of the creation of my keep the change checking account. (See Below)

Bank of America keep the change program

My $300 investment and $329.16 auto-invested change equals $629.16. YTD, it looks like the $128.41 yield I am expecting from Bank of America at the 1 year marker would be a 20% return on my own money.

The math: $300 + $329.16 = $629.16. $629.16 + $128.41 (matched from Bank of America) = $757.57. $757.57 divided by $629.16 = 1.20. 1.20 translates to the principal investment plus a new 20% in earnings!

😉

Frugal

ps. As mentioned in first Bank of America keep the change blogpost: “The restrictions are 100% match to your first 3 months of savings up to $60.00, and 5% of the rest of your savings, up to $250.00. If you are using the program to its maximum potential you would be getting a free $310 ($60 + $250) for free from Bank of America.”

by

admin |

Categories:

earn money,

save money,

Uncategorized | Tagged:

bank of america,

bank of america keep the change program,

checkcard,

earn money,

frugal francis,

keep the change program,

purchases,

savings,

update |

No Comments

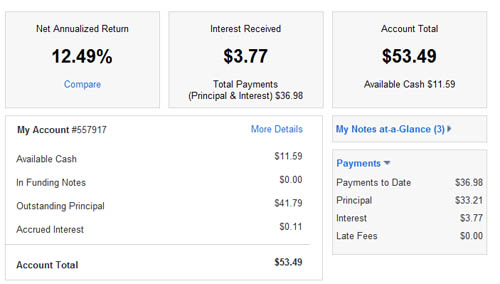

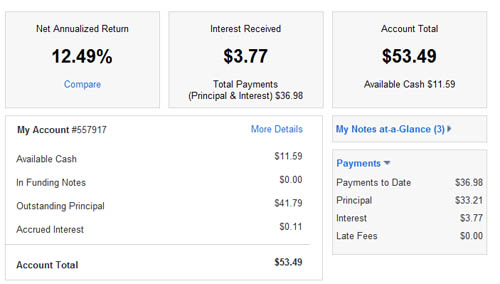

Back in October of ’09, I signed up for Lending Club for FREE. I had simply clicked a link from a blog I was reading and the next thing I knew I was given $25 to invest into Notes. With a free $25 to start the account and the referral credit I got of $25 bucks, my account started with $50. 11 months later, I am at $53.49.

Lending Club Update

Lending Club Update

Yes! You read correctly above, I have made $3.49 for FREE! Any new member gets a free $25 dollars, and additional money for referring people to Lending Club. In fact, when I referred someone I got $25 free but nowadays, I believe you can refer people and get a free $50. My free money of $50 has now turned into $53.49, which has grown 6.9% since Oct’ 09. Lending Club says my “Net Annualized return is 12+% but I don’t really understand how they compute that, nor do I care. I made almost 7% on FREE money that was given to me for clicking a simple link (below).

Give it a click, worst thing that happens is you just got a free $25 to loan to people and make money…

😉

Frugal

Hello Readers,

I apologize for the delay since my last post. I aim to start writing and sharing some thoughts on how to save money and will make a better effort in doing so for 2010.

Today I want to talk about Affiliate Advertising. Basically you can earn a commission from transactions that are made on the internet. A great example of this would be amazon. Amazon allows their affiliates to earn a %, usually around 3% on any products that are purchased with a referral from you.

I am reviewing LinkShare today which I think is a good site that allows you to easily get started in the Affiliate world.

Well, first and foremost, Hello World!

Yes, I did it, I put together a custom installed WordPress blog and it was really freakin’ easy to do so. In the past, I fiddled with installing WordPress by putting on an ftp server and running the install script, and while I was able to do it, I found it cumbersome and time-consuming. I will be sure to follow up a bit more about how easy this is to do in my next posting…

Frugal Francis is the name I will use for the blog that entertains users on how to save and earn money through the Internet. I plan on talking about a variety of topics on this blog, but all will reflect back to different ways to save money or ways to actually earn money on the Internet.

If you are looking for a get rich quick scheme and are in desperate need for money, then you came to the wrong site. Trust me, I’ve been fooled into a number of offers over the years, and there are a only a few ways to get rich on the Internet, and they all come with hard work and dedication.

I live and die by a principle that you need to earn more than you spend and SAVE as much as possible. I will be talking about crafty ways to save and earn money in this blog, so stay tuned!